Reports & Analytics Overview

Learn how to generate business insights using LKG Billing reports.

📊 What are Reports?

Reports help you understand your business performance through data analysis and visualization. The Reports section provides:

- Financial summaries

- Customer insights

- Product performance

- Payment tracking

- Tax calculations

- Business trends

📈 Reports Dashboard

When you navigate to Reports, you'll see the main analytics dashboard.

Dashboard Features

- Quick Stats - Key metrics at a glance

- Charts & Graphs - Visual data representation

- Report Templates - Pre-built report options

- Custom Reports - Create your own reports

- Export Options - Download in PDF, Excel, CSV

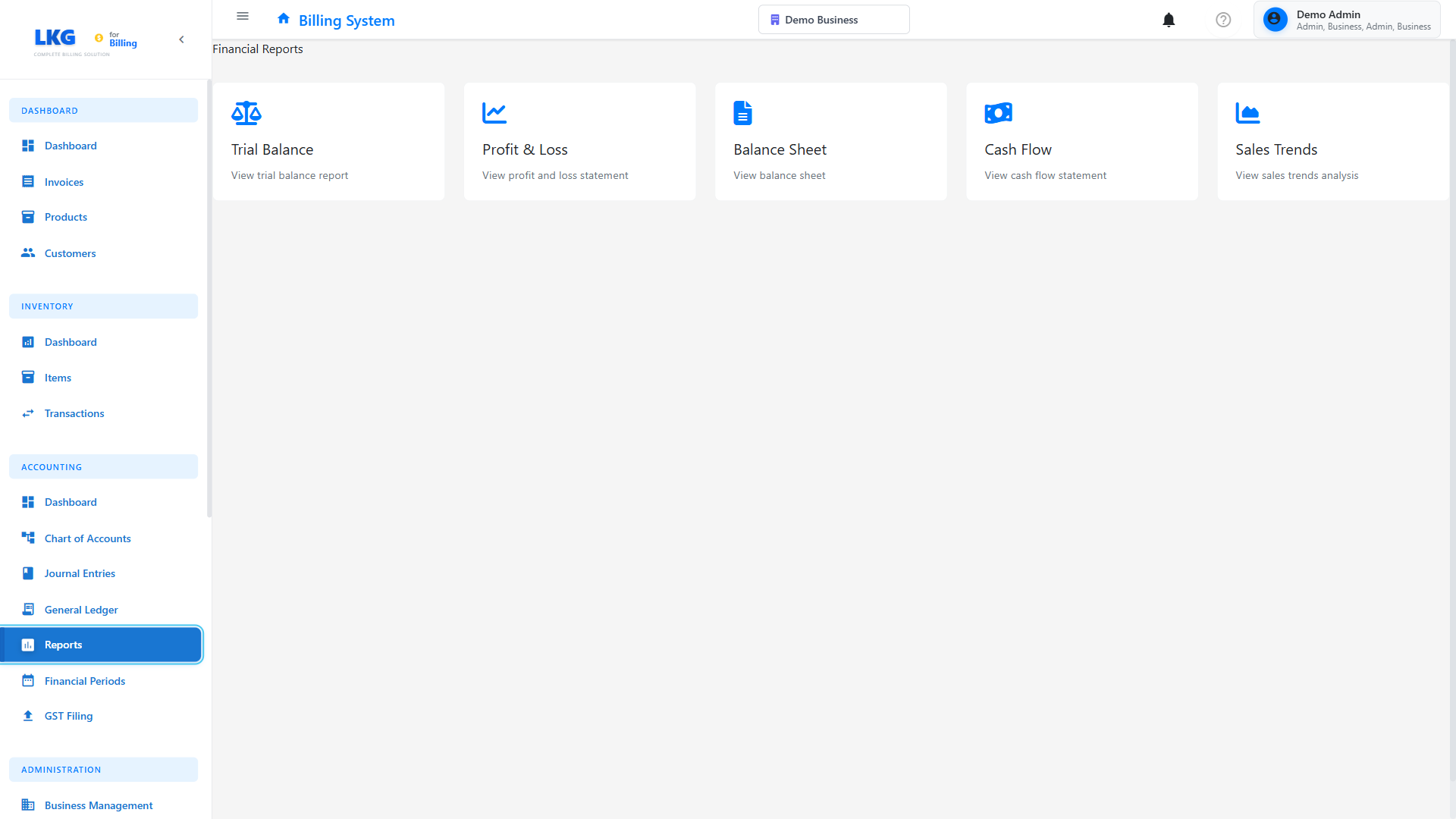

📋 Available Reports

Financial Reports

Sales Report

Track revenue and sales performance.

Includes:

- Total sales by period

- Sales by customer

- Sales by product

- Revenue trends

- Comparison with previous periods

Sample Output:

Sales Report - November 2024

Total Sales: ₹5,47,200

Total Invoices: 45

Average Invoice: ₹12,160

Growth vs Last Month: +15%

Top Customers:

1. Acme Corp - ₹85,000

2. Tech Solutions - ₹67,500

3. Mumbai Retail - ₹54,200

Revenue Report

Analyze income patterns.

Includes:

- Monthly revenue

- Revenue by category

- Recurring vs one-time

- Revenue forecasts

Profit & Loss (P&L)

Complete financial statement.

Includes:

- Total income

- Expenses (if tracked)

- Gross profit

- Net profit

- Profit margins

Invoice Reports

Invoice Summary

Overview of all invoices.

Filters:

- Date range

- Status (Paid, Pending, Overdue)

- Customer

- Amount range

Sample:

Invoice Summary - Q4 2024

Total Invoices: 127

Paid: 89 (₹4,23,500)

Pending: 28 (₹1,56,800)

Overdue: 10 (₹67,900)

Draft: 5 (₹45,200)

Aging Report

Track overdue invoices by age.

Aging Buckets:

- Current (0-30 days)

- 31-60 days overdue

- 61-90 days overdue

- 90+ days overdue

Sample:

Accounts Receivable Aging Report

Current (0-30): ₹1,25,000

31-60 days: ₹45,000

61-90 days: ₹18,500

90+ days: ₹4,400

Total Outstanding: ₹1,92,900

Invoice Status Report

Breakdown by status.

Shows:

- Count and value by status

- Status change timeline

- Conversion rates

Payment Reports

Payments Received

Track all incoming payments.

Includes:

- Payment date

- Amount

- Method

- Customer

- Invoice reference

Sample:

Payments Received - November 2024

Total Payments: ₹4,23,500

Number of Transactions: 67

By Method:

Bank Transfer: ₹2,85,000 (67%)

UPI: ₹89,500 (21%)

Cash: ₹34,000 (8%)

Card: ₹15,000 (4%)

Outstanding Payments

See what's owed.

Includes:

- Customer name

- Invoice number

- Amount due

- Days overdue

- Contact information

Payment Method Report

Analyze payment preferences.

Shows:

- Breakdown by method

- Average transaction size

- Processing fees

- Trends over time

Customer Reports

Customer List

Complete customer database.

Export Includes:

- Customer details

- Contact information

- Total business value

- Last transaction date

Top Customers

Identify best customers.

Ranked By:

- Total revenue

- Number of invoices

- Average order value

- Payment reliability

Sample:

Top 10 Customers - 2024

1. Acme Corporation

Revenue: ₹5,45,000

Invoices: 15

Avg: ₹36,333

2. Tech Solutions Pvt Ltd

Revenue: ₹4,23,500

Invoices: 23

Avg: ₹18,413

Customer Activity

Track customer engagement.

Shows:

- New customers

- Active customers

- Inactive customers

- Churn rate

Product Reports

Product Sales

Track product performance.

Includes:

- Units sold

- Revenue generated

- Growth trends

- Seasonal patterns

Sample:

Product Sales Report - 2024

Top Products:

1. Website Design Package

Sold: 23 times

Revenue: ₹5,75,000

2. Professional Consulting (Hourly)

Hours: 456

Revenue: ₹6,84,000

Inventory Report

(If inventory tracking enabled)

Shows:

- Stock levels

- Items sold

- Reorder alerts

- Stock value

Tax Reports

Tax Summary

Calculate tax collected.

Includes:

- GST/VAT collected

- Tax by rate (5%, 12%, 18%)

- Period totals

- Filing-ready formats

Sample:

GST Summary - Q4 2024

18% GST: ₹76,536

12% GST: ₹18,240

5% GST: ₹4,250

Total Tax Collected: ₹99,026

Output Tax: ₹99,026

Input Tax: ₹15,400

Net GST Payable: ₹83,626

Tax by Product

See which products generate tax revenue.

GSTR Reports (India)

GST return-ready reports.

Available:

- GSTR-1 (Outward supplies)

- GSTR-3B (Summary return)

- GSTR-9 (Annual return)

📅 Report Filters

Customize reports with filters:

Date Range

- Today

- This Week

- This Month

- This Quarter

- This Year

- Custom Date Range

- Last 30/60/90 days

Customer

- All Customers

- Specific Customer

- Customer Group

Status

- All Statuses

- Paid Only

- Pending Only

- Overdue Only

Product

- All Products

- Specific Product

- Category

Amount Range

- Minimum amount

- Maximum amount

📥 Exporting Reports

Download reports in various formats:

PDF

- Professional formatting

- Ready to print

- Email-friendly

Excel (XLSX)

- Editable spreadsheet

- Includes formulas

- Pivot table ready

CSV

- Import into other systems

- Database compatible

- Lightweight format

📊 Report Scheduling

Automate report generation:

Setup:

- Choose report type

- Set filters

- Select frequency:

- Daily

- Weekly

- Monthly

- Quarterly

- Add email recipients

- Save schedule

Example:

Scheduled Report: Monthly Sales Summary

Frequency: Last day of every month

Format: PDF + Excel

Recipients: owner@business.com, accounts@business.com

💡 Using Reports Effectively

- Review Weekly - Check key reports every week

- Track Trends - Look for patterns over time

- Act on Insights - Use data to make decisions

- Compare Periods - Month-over-month, year-over-year

- Monitor Overdue - Follow up on aged invoices

- Identify Top Customers - Focus on valuable clients

- Analyze Products - Promote best sellers

- Tax Compliance - Generate tax reports before deadlines

📈 Key Metrics to Monitor

Revenue Metrics

- Monthly Recurring Revenue (MRR)

- Average Invoice Value

- Revenue Growth Rate

Customer Metrics

- Customer Acquisition

- Customer Lifetime Value

- Customer Retention Rate

Operational Metrics

- Average Payment Time

- Invoice-to-Cash Cycle

- Overdue Percentage

Financial Health

- Outstanding AR

- Collection Efficiency

- Profit Margins

🎯 Common Report Use Cases

Monthly Financial Review

- Generate Sales Report

- Check Payment Report

- Review Aging Report

- Calculate Tax Summary

Customer Analysis

- Run Top Customers Report

- Check Customer Activity

- Identify At-Risk Customers

- Plan retention strategies

Tax Filing Preparation

- Generate Tax Summary

- Export GSTR Reports

- Verify tax calculations

- Submit to accountant

Business Planning

- Analyze revenue trends

- Forecast next quarter

- Identify growth opportunities

- Set targets

🚀 Next Steps

- Invoice Management - Managing invoices

- Payment Tracking - Payment management

- Settings - Configure reporting options

Ready to generate reports? Explore specific report types in the next sections! 👉