Invoice Management Overview

Learn how to create and manage invoices in LKG Billing.

📋 What are Invoices?

Invoices are formal requests for payment sent to customers for goods or services provided. The Invoice Management section helps you:

- Create professional invoices

- Track invoice status (Draft, Sent, Paid, Overdue)

- Send invoices to customers via email

- Record payments against invoices

- Generate invoice reports

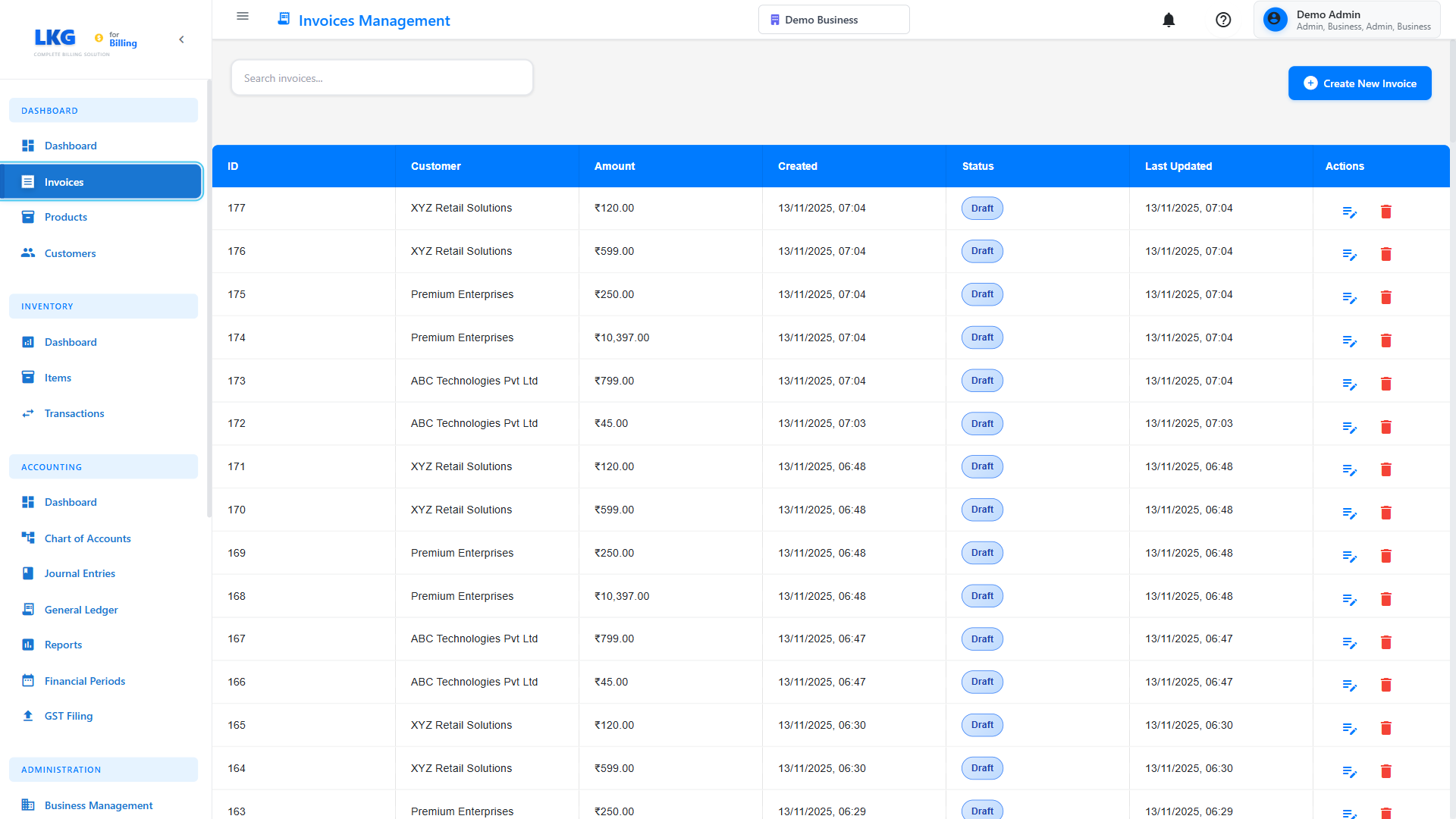

📊 Invoice List View

When you navigate to the Invoices section, you'll see all your invoices.

List Features

- Search Bar - Find invoices by number, customer, or amount

- Filter Options - Filter by status, date, customer

- Create Invoice Button - Generate new invoices

- Invoice Table - View all invoice details

Each invoice entry typically shows:

- Invoice number (e.g., INV-2024-001)

- Customer name

- Invoice date

- Due date

- Total amount

- Status badge (Paid, Pending, Overdue)

- Quick actions (View, Edit, Delete, Send)

🏷️ Invoice Statuses

Invoices can have different statuses:

📝 Draft

- Invoice is being prepared

- Not yet sent to customer

- Can be edited freely

- Not included in reports

📤 Sent

- Invoice has been sent to customer

- Awaiting payment

- Customer can view the invoice

- Included in pending reports

✅ Paid

- Payment has been received

- Invoice is closed

- Included in revenue reports

- Cannot be edited

⚠️ Overdue

- Payment due date has passed

- Payment not received

- Needs follow-up

- Included in overdue reports

🔍 Searching and Filtering

Search Invoices

Find invoices using:

- Invoice number:

INV-2024-001 - Customer name:

John Doe - Amount:

1500 - Date range

Filter Options

- By Status: All, Draft, Sent, Paid, Overdue

- By Date: Today, This Week, This Month, Custom Range

- By Customer: Select from dropdown

- By Amount: Min and Max range

📊 Invoice Information

Click on any invoice to view complete details:

Header Information

- Invoice number

- Invoice date

- Due date

- Reference/PO number

Customer Details

- Customer name

- Billing address

- Email and phone

- Tax ID (if applicable)

Line Items

- Product/Service name

- Description

- Quantity

- Unit price

- Tax rate

- Line total

Calculations

- Subtotal

- Tax amount

- Discount (if any)

- Total amount

- Amount paid

- Balance due

🎯 Common Invoice Actions

Create New Invoice

Learn how to create a new invoice.

Edit Invoice

- Find the invoice (must be in Draft status)

- Click Edit

- Make changes

- Click Save

Editing Restrictions

Only Draft invoices can be edited. For Sent/Paid invoices, create a credit note instead.

Send Invoice

- Open the invoice

- Click Send button

- Verify customer email

- Add a message (optional)

- Click Send Email

Record Payment

- Open the invoice

- Click Record Payment

- Enter payment details

- Save payment record

Learn more: Recording Payments

Download/Print

- PDF: Download as PDF for printing or emailing

- Print: Print directly from browser

- Email: Send PDF via email

💡 Invoice Management Tips

Best Practices

- Sequential Numbers - Use automatic numbering for better organization

- Clear Descriptions - Write detailed line item descriptions

- Set Due Dates - Typically 15-30 days from invoice date

- Send Promptly - Send invoices immediately after service delivery

- Follow Up - Send reminders for overdue invoices

- Keep Records - Don't delete finalized or paid invoices

📧 Email Templates

Customize email templates for:

- New invoice notification

- Payment reminder (7 days before due)

- Overdue notice (after due date)

- Payment received confirmation

- Thank you message

Configure in: Settings → Email Templates

📊 Invoice Reports

Generate reports to analyze:

- Total invoices by status

- Revenue by period

- Outstanding amounts

- Customer payment history

- Tax collected

Learn more: Reports

🚀 Next Steps

- Create Your First Invoice - Step-by-step guide

- Draft Invoices - Working with drafts

- Edit Invoices - Making changes to invoices

- Invoice Payments - Managing payments

Ready to create invoices? Click Next to learn how! 👉