Settings Overview

Complete guide to configuring LKG Billing to match your business needs.

⚙️ Settings Categories

The Settings section is organized into several categories:

- Profile Settings - Your user account preferences

- Business Settings - Company information and defaults

- Invoice Settings - Invoice numbering, terms, and templates

- Tax Settings - GST/Tax rates and configurations

- Payment Settings - Payment methods and bank accounts

- HSN/SAC Codes - Product classification for GST compliance

- User Management - Team members and permissions (Admin only)

- Integration Settings - Third-party connections

- Security Settings - Password, 2FA, and access controls

Accessing Settings

Navigation

- Click your profile icon or username in the top right

- Select Settings from the dropdown

- Or click Settings in the main sidebar (if available)

Settings Dashboard

The settings dashboard shows:

- Quick access cards for each settings category

- Recently modified settings

- Recommendations for incomplete setup

- System status and updates

Profile Settings

Personal Information

Update your user profile:

Basic Info:

-

Full Name - Your display name

Example:Rajesh Kumar -

Email Address - Your login email (may be locked)

Example:rajesh@company.com -

Phone Number - Contact number

Example:+91 98765 43210 -

Role - Your user role (view only, set by admin)

Options: Admin, Manager, User, Read-Only

Profile Picture:

- Click Change Picture or upload icon

- Select image file (JPG, PNG under 2MB)

- Crop if needed

- Click Save

Password Change:

- Click Change Password

- Enter current password

- Enter new password (min 8 characters, mix of letters/numbers/symbols)

- Confirm new password

- Click Update Password

Notification Preferences

Configure email and in-app notifications:

Email Notifications:

- ✅ New invoice created

- ✅ Invoice paid

- ✅ Payment reminder sent

- ✅ Customer added

- ✅ Low stock alerts

- ❌ Daily summary email (opt-out)

- ❌ Weekly reports (opt-out)

In-App Notifications:

- ✅ Payment received

- ✅ Invoice overdue

- ✅ System updates

- ✅ Comments/mentions

Notification Frequency:

- Real-time (immediate)

- Hourly digest

- Daily digest

- Weekly summary

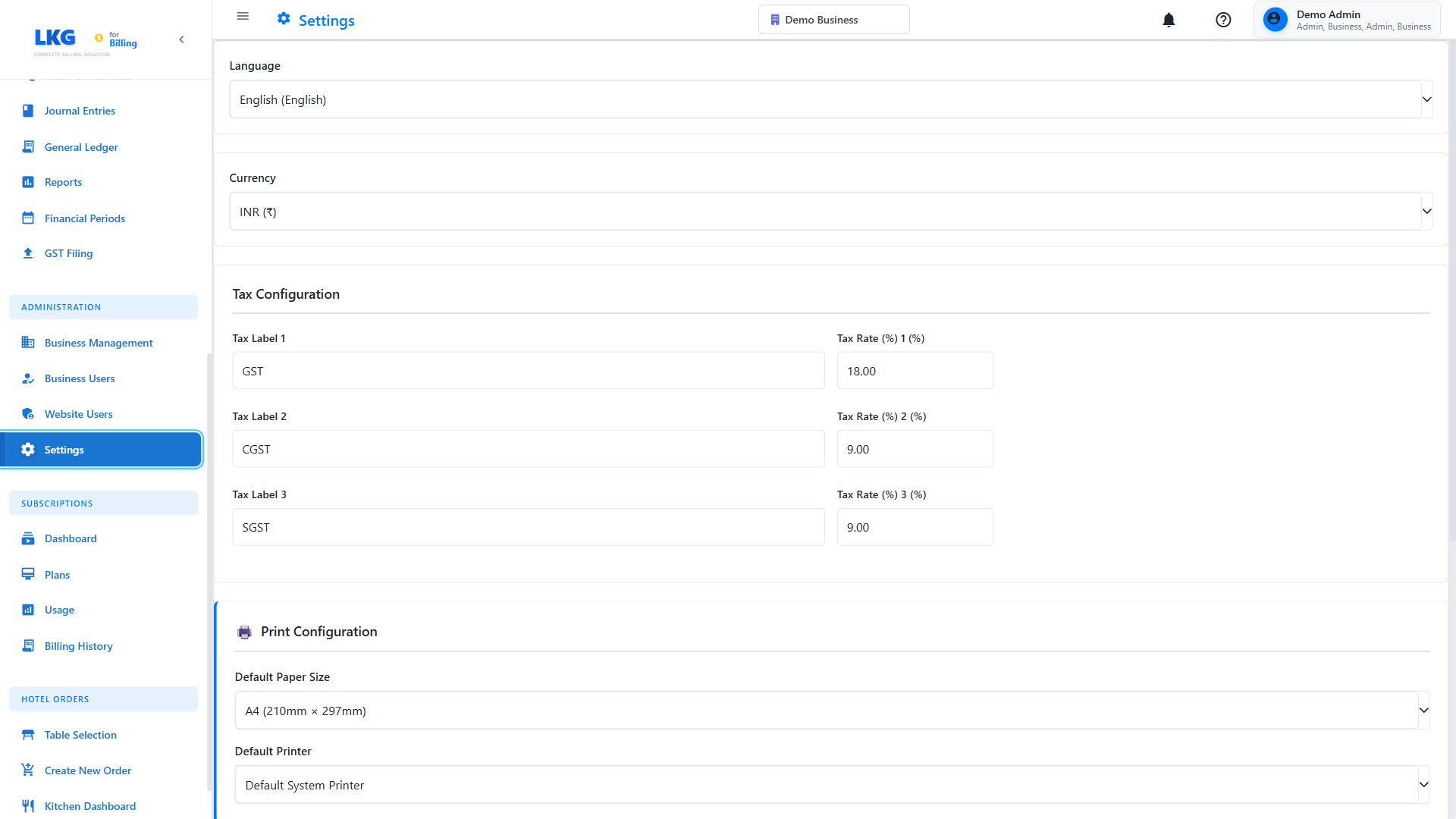

Display Preferences

Customize your interface:

Language:

- English (Default)

- Hindi

- Regional languages (if available)

Date Format:

- DD/MM/YYYY (Indian format)

- MM/DD/YYYY (US format)

- YYYY-MM-DD (ISO format)

Time Format:

- 12-hour (3:30 PM)

- 24-hour (15:30)

Currency Display:

- Symbol first: ₹1,000

- Symbol last: 1,000₹

- With separator: ₹1,000.00

Number Format:

- Indian (1,00,000)

- International (100,000)

Theme:

- Light mode (default)

- Dark mode

- Auto (follows system)

Business Settings

Company Information

Configure your business details for invoices and documents:

Business Details:

-

Company Name (Required)

Example:Acme Technologies Pvt Ltd -

Legal Business Name

Example:Acme Technologies Private Limited -

Business Type

Options: Sole Proprietorship, Partnership, Private Limited, Public Limited, LLP -

Industry

Example:Information Technology,Manufacturing,Retail

Contact Information:

-

Email (appears on invoices)

Example:billing@acmetech.com -

Phone

Example:+91 80 1234 5678 -

Website

Example:www.acmetech.com

Business Address:

-

Address Line 1

Example:123, MG Road -

Address Line 2 (optional)

Example:Koramangala 4th Block -

City

Example:Bangalore -

State/Province

Example:Karnataka -

Postal/ZIP Code

Example:560034 -

Country

Example:India

Tax Registration:

-

GSTIN (Goods and Services Tax Identification Number)

Format:29ABCDE1234F1Z5

Example:29AABCT1332L1ZB -

PAN (Permanent Account Number)

Format:ABCDE1234F

Example:AABCT1332L -

TAN (Tax Deduction Account Number) - if applicable

Format:ABCD12345E -

CIN (Corporate Identity Number) - for companies

Example:U72900KA2015PTC123456

Business Logo:

Upload your company logo for invoices and documents:

- Click Upload Logo

- Select image (recommended: 300x100 px, PNG with transparent background)

- Preview how it appears on invoice

- Click Save

Business Defaults

Set default values for new records:

Invoice Defaults:

- Default payment terms: Net 30 days

- Default tax rate: 18% (IGST)

- Invoice prefix: INV-

- Invoice note template

Product Defaults:

- Default unit of measurement: Piece

- Default tax rate: 18%

- Default HSN code (see HSN Settings below)

Customer Defaults:

- Default payment terms: Net 30

- Default currency: INR

- Auto-send invoice on creation: No

Financial Year

Configure fiscal year settings:

Financial Year:

- Start Month: April (common in India)

- End Month: March

- Or: January to December

Year Closing:

- Last closing date: March 31, 2024

- Next closing date: March 31, 2025

- Auto-close year: Yes/No

Invoice Settings

Invoice Numbering

Configure how invoices are numbered:

Numbering Format:

Choose a numbering pattern:

- Sequential: 1, 2, 3, ...

- Prefixed: INV-001, INV-002, ...

- Date-based: INV-2024-001, INV-2024-002

- Custom: BILL-NOV-001, ACME-2024-001

Configuration:

- Prefix (optional):

INV- - Date Format (optional):

YYYY-,YYYY-MM- - Starting Number:

1or001 - Padding: 3 digits (001, 002), 4 digits (0001, 0002)

- Next Invoice Number: (auto-calculated, can override)

Examples:

INV-001, INV-002, INV-003

BILL-2024-001, BILL-2024-002

2024-NOV-0001, 2024-NOV-0002

ACME-001, ACME-002

Reset Options:

- Never reset

- Reset annually (April 1)

- Reset monthly

- Reset quarterly

Invoice Templates

Customize invoice appearance:

Select Template:

- Classic (traditional layout)

- Modern (clean, minimal)

- Professional (corporate style)

- Custom (your HTML template)

Template Customization:

- Header color

- Font style and size

- Show/hide fields (PO Number, Bank Details, etc.)

- Footer text

- Terms and conditions

Preview:

- View sample invoice with your settings

- Test with actual invoice data

- Print preview

Payment Terms

Configure standard payment terms:

Predefined Terms:

- Due on Receipt

- Net 7 (payment within 7 days)

- Net 15

- Net 30 (most common)

- Net 45

- Net 60

- Net 90

Custom Terms: Create custom payment terms:

- Term Name:

Advance Payment Required - Days:

0(before delivery) - Description:

50% advance, 50% on delivery

Late Payment:

- Enable late payment fees: Yes/No

- Late fee percentage: 1.5% per month

- Grace period: 3 days

- Compound interest: Yes/No

Invoice Email Settings

Configure automatic invoice emails:

Email Template:

Customize the email sent with invoices:

Subject Line:

Invoice {invoice_number} from {company_name}

Email Body:

Dear {customer_name},

Thank you for your business. Please find attached invoice {invoice_number} for {invoice_amount}.

Payment is due by {due_date}.

Best regards,

{company_name}

Available Variables:

{customer_name}{invoice_number}{invoice_amount}{due_date}{company_name}

Email Settings:

- Auto-send on invoice creation: Yes/No

- Attach PDF: Yes (recommended)

- Include payment link: Yes/No

- CC yourself: Yes/No

Tax Settings

Tax Rates

Configure GST and other tax rates:

Indian GST Rates:

- CGST (Central GST): 9%

- SGST (State GST): 9%

- IGST (Integrated GST): 18%

- UTGST (UT GST): Applicable for Union Territories

Standard Rates:

- 0% (Nil Rated)

- 0.25%

- 3%

- 5%

- 12%

- 18% (most common)

- 28%

Add Custom Tax Rate:

- Click Add Tax Rate

- Enter rate name:

GST 18% - Enter percentage:

18 - Select type: CGST+SGST or IGST

- Set as default: Yes/No

- Click Save

Tax Rules

Configure when and how taxes apply:

Intra-State (Same State):

- Apply CGST + SGST

- Example: Karnataka to Karnataka = 9% CGST + 9% SGST = 18% total

Inter-State (Different States):

- Apply IGST

- Example: Karnataka to Maharashtra = 18% IGST

Tax Exemptions:

- Products under ₹1,000: GST exempt (example)

- Healthcare services: 0% GST

- Educational services: 0% GST

Reverse Charge Mechanism

Configure reverse charge scenarios:

- Certain services from unregistered dealers

- Legal and professional services

- Security services

- Goods transport agency services

Enable Reverse Charge:

- For specific customers: Yes/No

- Auto-apply based on service type: Yes/No

Payment Settings

Payment Methods

Enable and configure payment methods:

Available Methods:

✅ Cash

- No setup required

- Track cash sales

- Manual reconciliation

✅ Bank Transfer (NEFT/RTGS/IMPS)

- Add bank account details

- Enable for invoices

- Require UTR number

✅ UPI/Digital Wallets

- Add UPI ID

- Show QR code on invoice

- Integrate with payment gateway

✅ Credit/Debit Card

- Requires payment gateway

- Merchant fees apply

- Instant confirmation

✅ Cheque/Check

- Enable check payments

- Track check numbers

- Monitor clearing status

✅ Online Payment Gateway

- Integrate Razorpay/Stripe/PayU

- Provide API keys

- Configure webhook

Default Payment Method: Select default for quick entry:

- Bank Transfer (recommended for B2B)

- Cash (for retail)

- UPI (for small amounts)

Bank Accounts

Add your bank accounts for payment tracking:

Add Bank Account:

- Click Add Bank Account

- Enter details:

- Bank Name:

HDFC Bank - Account Holder Name:

Acme Technologies Pvt Ltd - Account Number:

12345678901234 - IFSC Code:

HDFC0001234 - Branch:

Koramangala, Bangalore - Account Type: Current, Savings, or Other

- Bank Name:

- Set as default: Yes/No

- Enable for online payments: Yes/No

- Click Save

UPI Details:

Add UPI ID for digital payments:

- UPI ID:

acmetech@hdfcbank - Generate QR Code: Yes

- Show on Invoice: Yes

Bank Details on Invoice:

Choose what to display:

- Show bank name and account number

- Show IFSC code

- Show branch

- Show UPI ID and QR code

HSN/SAC Code Settings

What are HSN/SAC Codes?

HSN (Harmonized System of Nomenclature):

- For goods/products

- 8-digit classification

- Required for GST compliance

SAC (Services Accounting Code):

- For services

- 6-digit classification

- Required for service invoices

Businesses with turnover > ₹5 crore must use 6-digit HSN codes.

Businesses with turnover ₹1.5-5 crore can use 4-digit codes.

Below ₹1.5 crore: 2-digit codes or optional.

HSN Code Master List

Access and configure HSN codes:

View HSN Codes:

- Go to Settings → HSN/SAC Codes

- View list of all HSN codes

- Search by code or description

- Filter by chapter or category

HSN Code Structure:

Example HSN Code: 84713000

- 84: Chapter (Nuclear reactors, boilers, machinery)

- 8471: Heading (Automatic data processing machines)

- 847130: Subheading (Portable digital computers)

- 84713000: Full HSN (Laptops, notebooks)

Adding HSN Codes

Add Custom HSN Code:

- Click Add HSN Code

- Enter code:

84713000 - Enter description:

Laptops and Notebook Computers - Select GST rate:

18% - Set as favorite: Yes (for quick access)

- Click Save

Import HSN Codes:

Import from standard GST HSN list:

- Click Import HSN Codes

- Select GST HSN Master List

- Choose chapters to import (or import all)

- Click Import

- Codes added to your master list

HSN Code Management

When creating products, you can enter HSN/SAC codes manually:

- Go to Products → Create Product

- Enter the HSN code in the HSN Code field

- Common HSN codes for reference:

- 84713000 - Laptops

- 85176200 - Mobile Phones

- Various service codes (SAC)

Ensure you use the correct HSN/SAC code for GST compliance. Refer to the official GST HSN code list.

Default HSN Codes

Set default HSN codes for product types:

By Product Category:

- Electronics → HSN Chapter 84/85

- Textiles → HSN Chapter 50-63

- Food Products → HSN Chapter 01-24

- Services → SAC Codes

Auto-Assign HSN:

Configure auto-assignment:

- Enable Auto-Assign HSN Code

- Rules:

- If product category = Electronics, use HSN 8471

- If product type = Service, use SAC 9983

- Manual override allowed: Yes

SAC Codes for Services

Add service accounting codes:

Common SAC Codes:

- 998314 - Information technology design and development services

- 998315 - Web hosting and related services

- 998316 - Software development services

- 998313 - IT consulting services

- 996511 - Legal services

- 998212 - Accounting and bookkeeping

Add SAC Code:

- Click Add SAC Code

- Enter code:

998314 - Description:

Software Development Services - GST Rate:

18% - Click Save

User Management (Admin Only)

Adding Users

Invite team members:

- Go to Settings → User Management

- Click Invite User

- Enter email:

newuser@company.com - Select role: Admin, Manager, User, Read-Only

- Set permissions (see below)

- Click Send Invitation

- User receives email with setup link

User Roles and Permissions

Admin:

- Full access to all features

- Can manage users

- Can delete paid invoices (with audit)

- Can modify all settings

Manager:

- Create and edit all records

- Cannot delete paid invoices

- Cannot manage users

- Can view reports

User:

- Create and edit own records

- Cannot delete finalized invoices

- Limited settings access

- Can view own reports

Read-Only:

- View all records

- Cannot create or edit

- Cannot delete anything

- Can export and print

Custom Permissions:

Fine-tune access:

- Customers: View, Create, Edit, Delete

- Products: View, Create, Edit, Delete

- Invoices: View, Create, Edit, Delete

- Reports: View, Export

- Settings: View, Modify

Managing Users

Edit User:

- Find user in list

- Click Edit

- Change role or permissions

- Click Save

Deactivate User:

- Find user in list

- Click Deactivate

- User cannot log in

- Data preserved

- Can reactivate later

Delete User:

- Find user in list

- Click Delete

- Permanently removes user

- Reassign their records first

Data Management

Export Data

Export your data for backup or analysis:

- Export invoices: CSV, Excel, PDF

- Export customers: CSV

- Export products: CSV

Backup and Export

Auto Backup:

- Enable daily backups: Yes

- Backup time: 2:00 AM

- Retention: 30 days

- Storage: Cloud / Local

Export Data:

- Export invoices: CSV, Excel, PDF

- Export customers: CSV

- Export products: CSV

- Export full database: ZIP

Security Settings

Password Policy

Configure password requirements:

- Minimum length: 8 characters

- Require uppercase: Yes

- Require numbers: Yes

- Require symbols: Yes

- Password expiry: 90 days

- Cannot reuse last 5 passwords

Session Management

Session Settings:

- Session timeout: 30 minutes of inactivity

- Remember me: 30 days

- Concurrent logins: 3 devices max

- Force logout on password change: Yes

IP Whitelisting

Restrict access by IP address:

- Enable IP whitelisting

- Add allowed IPs:

192.168.1.100(Office)203.0.113.0/24(Branch office range)

- Block all other IPs

Next Steps

- Profile Settings - Customize your dashboard

- Invoice Settings - Configure invoice defaults

- Product Management - Use HSN codes in products

- Reports - Leverage your configured settings

Pro Tip: Spend time setting up your HSN code filters properly. This will save significant time when creating products and ensure GST compliance!