Inventory Transactions

Track all stock movements and maintain a complete audit trail of your inventory changes.

What are Inventory Transactions?

Every time stock levels change, a transaction is automatically created to record:

- What changed - Product and quantity

- When it changed - Date and time

- Why it changed - Transaction type and reason

- Who changed it - User who made the change

- Reference - Related document or adjustment ID

Transaction Types

1. Purchase (Stock In) 📥

When: New stock is received

Automatically created when:

- Recording a purchase order receipt

- Marking supplier invoice as received

Details recorded:

- Purchase order number

- Supplier reference

- Quantity received

- Unit cost

- Total value

Example:

Type: Purchase

Product: Laptop - Dell Inspiron

Quantity: +10 units

Reference: PO-2024-001

Cost: ₹45,000 × 10 = ₹4,50,000

User: admin@company.com

Date: 20 Nov 2025, 10:30 AM

2. Sale (Stock Out) 📤

When: Products are sold to customers

Automatically created when:

- Invoice is created with products

- Sales order is fulfilled

- Delivery is marked as shipped

Details recorded:

- Invoice number

- Customer name

- Quantity sold

- Selling price

- Profit margin

Example:

Type: Sale

Product: Laptop - Dell Inspiron

Quantity: -2 units

Reference: INV-2024-0523

Selling Price: ₹52,000 × 2 = ₹1,04,000

Cost: ₹45,000 × 2 = ₹90,000

Profit: ₹14,000

User: sales@company.com

Date: 20 Nov 2025, 2:15 PM

3. Adjustment (Manual Correction) ⚙️

When: Manual stock corrections are needed

Reasons for adjustments:

- Physical count differences

- Damaged goods

- Lost items

- Found items

- Data entry errors

- Quality control rejections

Example:

Type: Adjustment

Product: Laptop - Dell Inspiron

Quantity: -1 unit

Reason: Damaged during shipping

Notes: "Screen cracked, unit unsellable"

User: warehouse@company.com

Date: 20 Nov 2025, 4:45 PM

4. Return (Customer/Supplier Return) 🔄

When: Products are returned

Customer Returns (Stock In):

Type: Return (In)

Product: Laptop - Dell Inspiron

Quantity: +1 unit

Reference: RET-CUS-2024-012

Reason: Customer return - defective

Notes: "Keyboard issue, replaced"

Supplier Returns (Stock Out):

Type: Return (Out)

Product: Laptop - Dell Inspiron (Defective)

Quantity: -1 unit

Reference: RET-SUP-2024-005

Reason: Returning defective unit to supplier

5. Transfer (Location Change) 🚚

When: Moving stock between locations

Example:

Type: Transfer

Product: Laptop - Dell Inspiron

Quantity: -5 units (from Warehouse A)

+5 units (to Store B)

Reference: TRF-2024-089

Notes: "Restocking retail location"

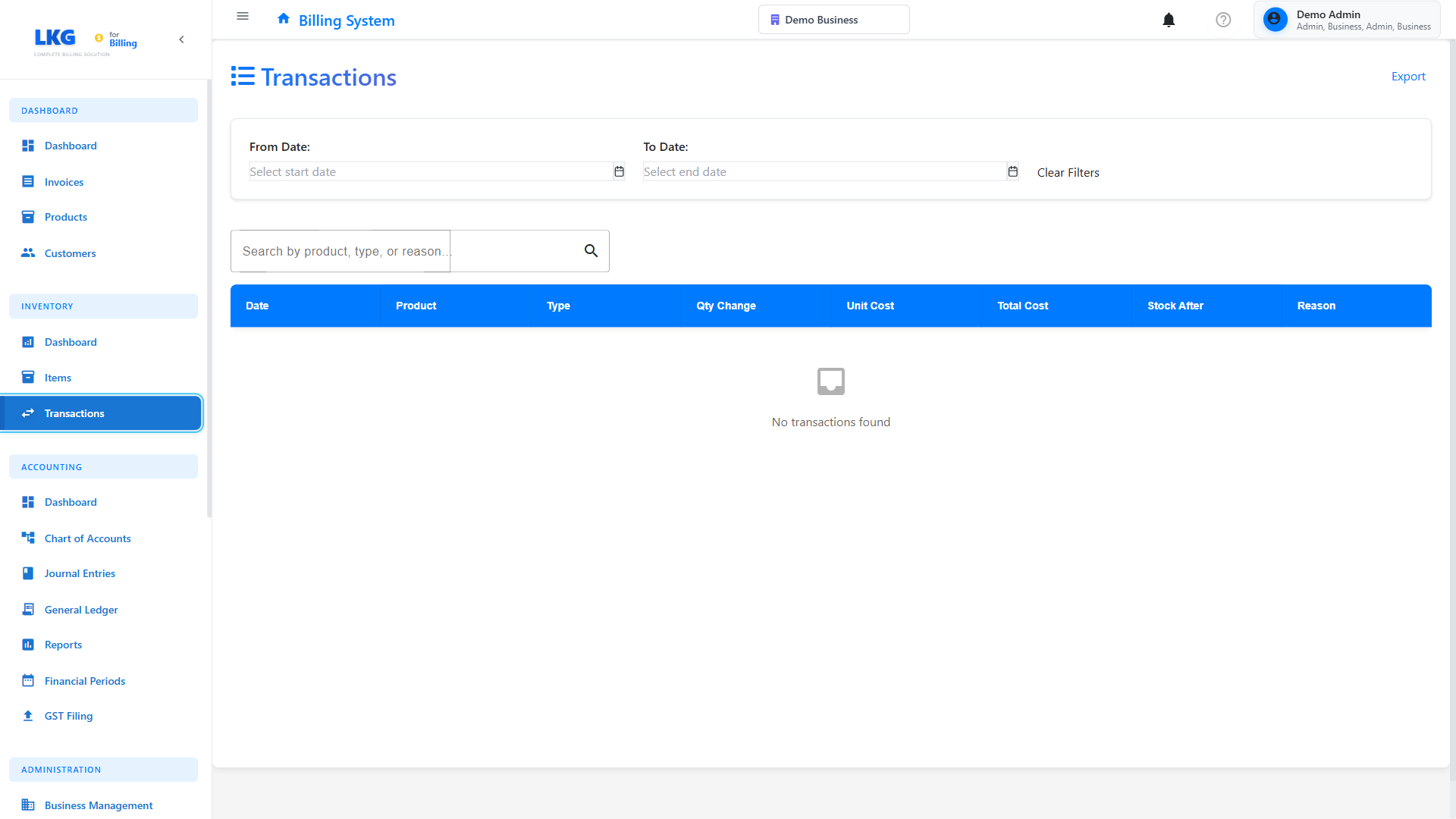

Viewing Transactions

Transaction List

The transactions page shows:

| Column | Description |

|---|---|

| Date/Time | When the transaction occurred |

| Product | Product name and SKU |

| Type | Transaction type icon and label |

| Quantity | Amount added (+) or removed (-) |

| Reference | Related document number |

| User | Who made the change |

| Stock After | Resulting stock level |

Filtering Transactions

Filter by:

Date Range:

- Today

- Last 7 days

- Last 30 days

- Custom date range

Transaction Type:

- All transactions

- Purchases only

- Sales only

- Adjustments only

- Returns only

- Transfers only

Product:

- All products

- Specific product

- Product category

- Low stock items

User:

- All users

- Specific user

- My transactions only

Transaction Details

Click any transaction to view complete details:

Basic Information

- Transaction ID

- Date and time (precise timestamp)

- Transaction type

- Status (completed, pending, cancelled)

Product Information

- Product name and SKU

- Product category

- Current stock level

- Stock after this transaction

Quantity Information

- Quantity changed (+ or -)

- Unit of measure

- Value per unit

- Total transaction value

Reference Information

- Reference document (invoice, PO, etc.)

- Reference number

- Link to source document

User Information

- User who created transaction

- User role

- IP address (for audit)

- Device/location

Additional Notes

- Reason for transaction

- Comments/notes

- Approvals (if required)

- Attachments

Automatic Transaction Creation

From Invoices

When you create an invoice with products:

-

Invoice Saved as Draft

- ✅ No inventory transaction created

- ❓ Stock not affected yet

-

Invoice Finalized

- ✅ Sale transaction created automatically

- 📤 Stock quantity reduced

- 📊 Transaction recorded

-

Invoice Cancelled

- ✅ Reversal transaction created

- 📥 Stock quantity restored

- 📝 Both transactions visible in history

From Purchase Orders

When receiving stock:

-

PO Created

- No inventory impact

-

Goods Received

- Purchase transaction created

- Stock increased

- Unit cost updated

-

Partial Receipts

- Multiple transactions created

- One per receipt

- Full audit trail

Manual Stock Adjustments

Making an Adjustment

- Navigate to Inventory → Items

- Find the product

- Click "Adjust Stock" button

- Enter adjustment details:

Adjustment Form:

Product: [Auto-filled]

Current Stock: [Display only]

Adjustment Type:

○ Add Stock (+)

○ Remove Stock (-)

○ Set Quantity (=)

Quantity: [Enter amount]

Reason:

○ Damaged

○ Lost/Stolen

○ Found/Discovered

○ Physical Count Correction

○ Quality Control

○ Other

Notes: [Required for Other]

- Click "Save Adjustment"

- Transaction is created immediately

Adjustment Examples

Example 1: Damaged Goods

Type: Adjustment (Remove)

Quantity: -3 units

Reason: Damaged

Notes: "Water damage from roof leak"

Stock: 50 → 47 units

Example 2: Physical Count

Type: Adjustment (Set)

New Quantity: 48 units

Current: 50 units

Difference: -2 units

Reason: Physical Count Correction

Notes: "Annual inventory audit"

Example 3: Found Stock

Type: Adjustment (Add)

Quantity: +5 units

Reason: Found/Discovered

Notes: "Found in back storage area"

Stock: 47 → 52 units

Transaction History & Audit Trail

Complete Audit Trail

Every transaction provides:

- Who - User identification

- What - Product and quantity

- When - Precise timestamp

- Why - Reason and reference

- Result - Before and after stock levels

Audit Reports

Generate reports for:

Stock Movement Report

- All transactions for date range

- By product or category

- By transaction type

User Activity Report

- All transactions by specific user

- Adjustments made

- Time period analysis

Variance Report

- Compare actual vs expected

- Identify discrepancies

- Shrinkage analysis

Best Practices

Record Keeping

Do:

- ✅ Add detailed notes to manual adjustments

- ✅ Use correct transaction types

- ✅ Include reference numbers

- ✅ Document reasons clearly

Don't:

- ❌ Use generic reasons like "Other"

- ❌ Skip notes on adjustments

- ❌ Make adjustments without investigation

- ❌ Delete transactions (contact admin)

Regular Reviews

Daily:

- Review today's transactions

- Verify sales are recorded

- Check for unusual adjustments

Weekly:

- Analyze transaction patterns

- Identify high-movement items

- Review user activity

Monthly:

- Generate variance reports

- Investigate discrepancies

- Reconcile with financial records

Quarterly:

- Audit trail review

- Physical inventory count

- Process improvement review

Investigating Discrepancies

When stock doesn't match expectations:

-

Check Recent Transactions

- Look at last 10 transactions

- Verify quantities

- Check transaction types

-

Review Related Documents

- Open linked invoices

- Check purchase orders

- Verify delivery notes

-

Physical Verification

- Count actual stock

- Check storage locations

- Look for misplaced items

-

Make Correction

- Create adjustment transaction

- Document investigation findings

- Implement preventive measures

Troubleshooting

Transaction Not Created

Problem: Sale completed but no transaction

Solutions:

- Check if invoice is finalized

- Verify product has inventory item

- Check inventory tracking is enabled

- Contact system administrator

Incorrect Quantity

Problem: Transaction shows wrong quantity

Solutions:

- Create correcting adjustment

- Document original error

- Review process to prevent recurrence

- Don't try to delete the transaction

Missing Reference

Problem: Transaction has no reference number

Solutions:

- Manual adjustments may not have references

- Check transaction notes for details

- Contact user who created transaction

- Add notes if information available

Next Steps

- Stock Adjustments - Learn adjustment procedures in detail

- Inventory Items - Manage your inventory

- Dashboard Overview - Monitor inventory health

Security Note: Transaction history is immutable. Corrections are made with new transactions, not by editing or deleting existing ones. This ensures complete audit compliance.