Deleting Invoices

Learn when and how to delete invoices, understand deletion restrictions, and maintain proper audit trails.

🗑️ Deletion Rules by Status

Different invoice statuses have different deletion policies:

| Status | Can Delete? | Conditions |

|---|---|---|

| Draft | ✅ Yes | Anytime, no restrictions |

| Finalized/Sent | ⚠️ Limited | Admin only |

| Paid | ❌ No | Cannot delete, use credit note |

Deleting invoices with payments can violate accounting regulations. Always use credit notes for paid invoices.

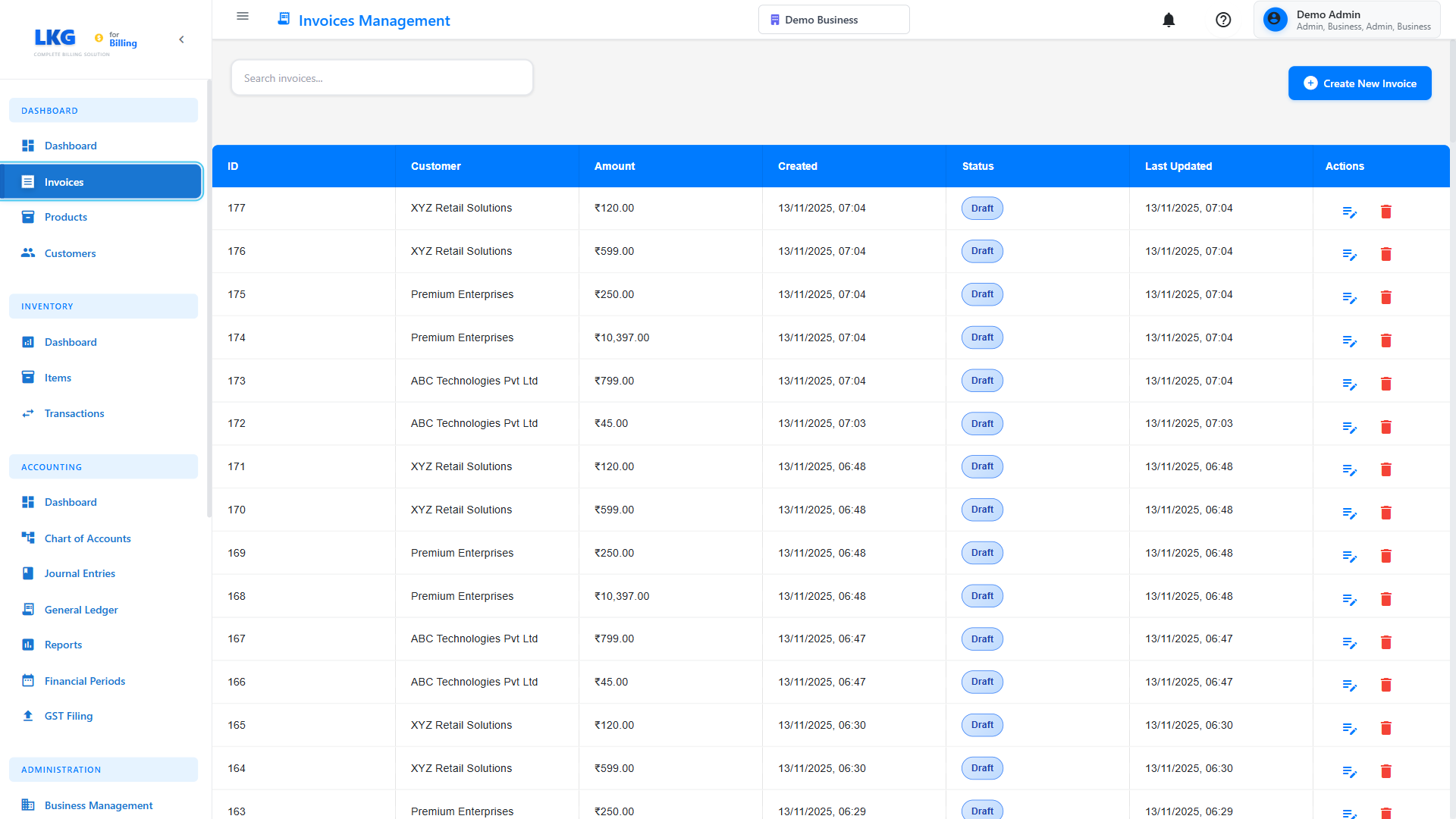

Deleting Draft Invoices

Single Draft Deletion

Draft invoices can be deleted freely:

- Go to Invoices page

- Filter by Draft status (optional)

- Find the draft invoice

- Click Actions menu (⋮)

- Select Delete

- Confirm deletion in the popup

- Invoice is permanently removed

Bulk Draft Deletion

Delete multiple drafts at once:

- Filter invoices to show Drafts

- Select checkboxes next to invoices to delete

- Click Bulk Actions dropdown

- Select Delete Selected

- Confirm bulk deletion

- All selected drafts are removed

Draft invoices haven't been sent to customers and don't affect accounting, so they're safe to delete.

Deleting Finalized/Sent Invoices

Deletion Restrictions

Finalized invoices have strict deletion rules:

❌ Regular Users - Cannot delete finalized invoices

⚠️ Admin Users - May be able to delete with audit log

✅ Recommended - Use void instead of delete

Admin Deletion Process

If deletion is absolutely necessary (admin only):

- Verify you have admin permissions

- Open the finalized invoice

- Click Actions → Delete

- System may show warning

- Enter deletion reason (required)

- Confirm deletion

- Entry added to audit log

Audit Log Entry:

Nov 20, 2024 3:45 PM - Admin User

Action: Deleted Invoice #INV-2024-156

Reason: Duplicate invoice created in error

Previous Status: Finalized

Amount: ₹5,000

Customer: ABC Corp

Better Alternative: Cancel Invoice

Instead of deleting finalized invoices, contact your administrator to handle the situation appropriately based on your business process.

Cannot Delete Invoices

Invoices with Payments

Invoices that have received any payment cannot be deleted:

❌ Partially Paid invoices

❌ Fully Paid invoices

❌ Overpaid invoices

Reason: Deleting would break accounting records and payment tracking.

Solution: Void and Credit Note

For paid invoices that need correction:

- Do NOT delete the paid invoice

- Create a Credit Note for the full amount

- This reverses the invoice in accounting

- Create a new correct invoice if needed

- Both invoices remain in system for audit trail

Example:

Original Invoice: INV-001 for ₹10,000 (Paid)

Credit Note: CN-001 for -₹10,000 (cancels INV-001)

New Invoice: INV-002 for ₹8,000 (correct amount)

Net Effect: ₹8,000 invoice, ₹2,000 credit to customer

Deletion Permissions

User Roles

Admin/Owner:

- Can delete draft invoices

- Can delete finalized invoices (with restrictions)

- Cannot delete paid invoices

- All deletions logged

Manager:

- Can delete own draft invoices

- May be able to delete team's finalized invoices

- Cannot delete paid invoices

- Requires approval for deletions

Regular User:

- Can delete own draft invoices

- Cannot delete finalized invoices

- Cannot delete paid invoices

- Limited deletion access

Read-Only User:

- Cannot delete any invoices

- View-only access

Requesting Deletion Permission

If you need to delete an invoice but don't have permission:

- Contact your system administrator

- Provide invoice number and reason

- Wait for approval or admin to delete

- Admin may void instead of delete

When to Delete

Use deletion for:

✅ Draft invoices - Not needed anymore

✅ Duplicate drafts - Created by mistake

✅ Test invoices - Created during system testing

✅ Incomplete work - Abandoned invoice attempts

Finalized invoices should not be deleted. Contact your administrator if you need to cancel a sent invoice.

Soft Delete vs. Hard Delete

Some systems use two types of deletion:

Soft Delete (Archive)

- Invoice marked as deleted but not removed

- Can be recovered/undeleted

- Still in database, just hidden

- Maintains complete history

- Preferred for finalized invoices

Hard Delete (Permanent)

- Invoice permanently removed from database

- Cannot be recovered

- No history preserved

- Only for drafts in most systems

- Use with extreme caution

Recovering Deleted Invoices

Undelete Soft-Deleted Invoices

If using soft delete:

- Go to Invoices → Deleted Invoices or Trash

- Find the deleted invoice

- Click Restore or Undelete

- Invoice returns to original status

- All data preserved

Soft-deleted invoices may auto-purge after 30-90 days. Restore before then!

Cannot Recover Hard-Deleted

Hard-deleted invoices cannot be recovered:

- No restore option available

- Must recreate from scratch

- Check backups if critical

- Contact support for database recovery (may not be possible)

Cascade Deletion Effects

What Happens When You Delete an Invoice

Deleting an invoice affects related records:

Deleted:

- Invoice header information

- Line items (products/services)

- Applied discounts

- Tax calculations

May Be Deleted:

- Draft-only attachments

- Unpublished comments/notes

NOT Deleted:

- Customer record

- Product records

- Payment records (if any exist, invoice cannot be deleted)

- Email history

- Audit logs

Orphaned Records

After deletion, check for:

- Unlinked payments (shouldn't happen if system prevents deletion)

- Floating credit notes

- Dangling references in reports

Common Deletion Scenarios

Scenario 1: Duplicate Draft Created

Problem: Accidentally created two draft invoices for same customer.

Solution:

- Identify which draft is correct

- Delete the duplicate draft

- Keep and finalize the correct one

Scenario 2: Sent Wrong Invoice to Customer

Problem: Sent invoice with wrong amount to customer.

Solution:

- Do NOT delete the sent invoice

- Email customer: "Please disregard INV-001, correct invoice to follow"

- Create new correct invoice (INV-002) with accurate information

- Send INV-002 to customer

- Keep the original for audit purposes

Scenario 3: Customer Canceled Order Before Payment

Problem: Customer canceled order, invoice was sent but not paid.

Solution:

- Do NOT delete the invoice

- Void the invoice with reason: "Order canceled by customer"

- Invoice number preserved for records

- Not included in revenue reports

Scenario 4: Need to Delete Old Test Invoices

Problem: System has test invoices from initial setup.

Solution:

- Filter invoices by early dates or test customer

- Verify they are test invoices (check for "test" in notes)

- Ensure they have no payments

- Bulk select test invoices

- Bulk delete (if admin)

- Or mark as voided with note "Test invoice"

Best Practices

Before Deleting

✅ Verify status - Check it's a draft or safe to delete

✅ Check for payments - Ensure no payments recorded

✅ Notify team - Inform others working on the invoice

✅ Document reason - Note why you're deleting

✅ Export data - Save a copy if needed for records

Instead of Deleting

✅ Void invoices - Better audit trail

✅ Create credit notes - Reverse paid invoices

✅ Archive old invoices - Keep but hide from active list

✅ Mark as canceled - If system has this status

✅ Add notes - Explain why invoice is invalid

Deletion Policy

Establish company policy:

- Drafts: Can be deleted freely

- Finalized: Void only, delete requires manager approval

- Paid: Never delete, use credit notes

- Retention: Keep all invoices for 7 years (adjust per local laws)

- Test data: Delete before going live

Audit Trail and Compliance

Deletion Logging

All invoice deletions should be logged:

Log Entry Includes:

- Who deleted (user name and ID)

- When deleted (date and time)

- What deleted (invoice number, customer, amount)

- Why deleted (reason entered by user)

- Previous status

Example Log:

Deleted Invoice Log Entry

------------------------

Date: Nov 20, 2024 4:15 PM

User: Jane Smith (Admin)

Invoice: INV-2024-234

Customer: XYZ Ltd

Amount: ₹7,500

Status: Finalized

Reason: Duplicate of INV-2024-235

IP Address: 192.168.1.100

Compliance Requirements

Different jurisdictions have different rules:

India (GST):

- Cannot delete invoices after GST filing

- Must maintain 6-year record

- Voiding is preferred to deletion

US (IRS):

- Keep records for 3-7 years

- Deleted invoices may trigger audits

- Maintain audit trails

EU (VAT):

- Cannot delete VAT invoices

- Must keep sequential numbering

- Voided invoices must be preserved

General Best Practice:

- Never delete paid invoices

- Maintain sequential invoice numbering

- Keep audit logs for all deletions

- Preserve records per legal requirements

Troubleshooting

Delete Button is Grayed Out

Possible Reasons:

- Invoice has payments (even ₹1)

- Invoice is paid or partially paid

- You don't have delete permission

- Invoice is locked by another user

- Invoice is finalized (depends on settings)

Solutions:

- Check invoice status

- Verify you have admin/delete permissions

- Check for any payments (even pending)

- Use void instead of delete

"Cannot Delete" Error Message

Common Error Messages:

"Invoice has payments and cannot be deleted"

- Solution: Void the invoice instead

"Insufficient permissions to delete invoice"

- Solution: Request admin access or ask admin to delete

"Invoice is locked for editing"

- Solution: Wait for other user to finish, or admin can unlock

"Cannot delete finalized invoice"

- Solution: System policy prevents deletion, use void

Accidentally Deleted Wrong Invoice

If Soft Delete:

- Go to Deleted/Trash immediately

- Restore the invoice

- All data recovered

If Hard Delete:

- Check recent backups (contact IT/support)

- May be able to restore from last night's backup

- If not recoverable, recreate manually from records

Next Steps

- Invoice Overview - Understanding invoice management

- Draft Invoices - Working with drafts

- Editing Invoices - Making changes

- Managing Payments - Recording payments

Critical Reminder: Always use Void instead of Delete for invoices that have been sent to customers or have payments. This maintains legal compliance and proper audit trails.