Managing Invoice Payments

Learn how to mark invoices as paid, record partial payments, and manage payment status.

💰 Payment Status Overview

Invoices can have different payment statuses throughout their lifecycle:

- Unpaid - No payment received

- Partially Paid - Some payment received, balance remaining

- Paid - Full payment received

- Overpaid - Payment exceeds invoice amount

- Refunded - Payment was returned to customer

Marking Invoice as Paid

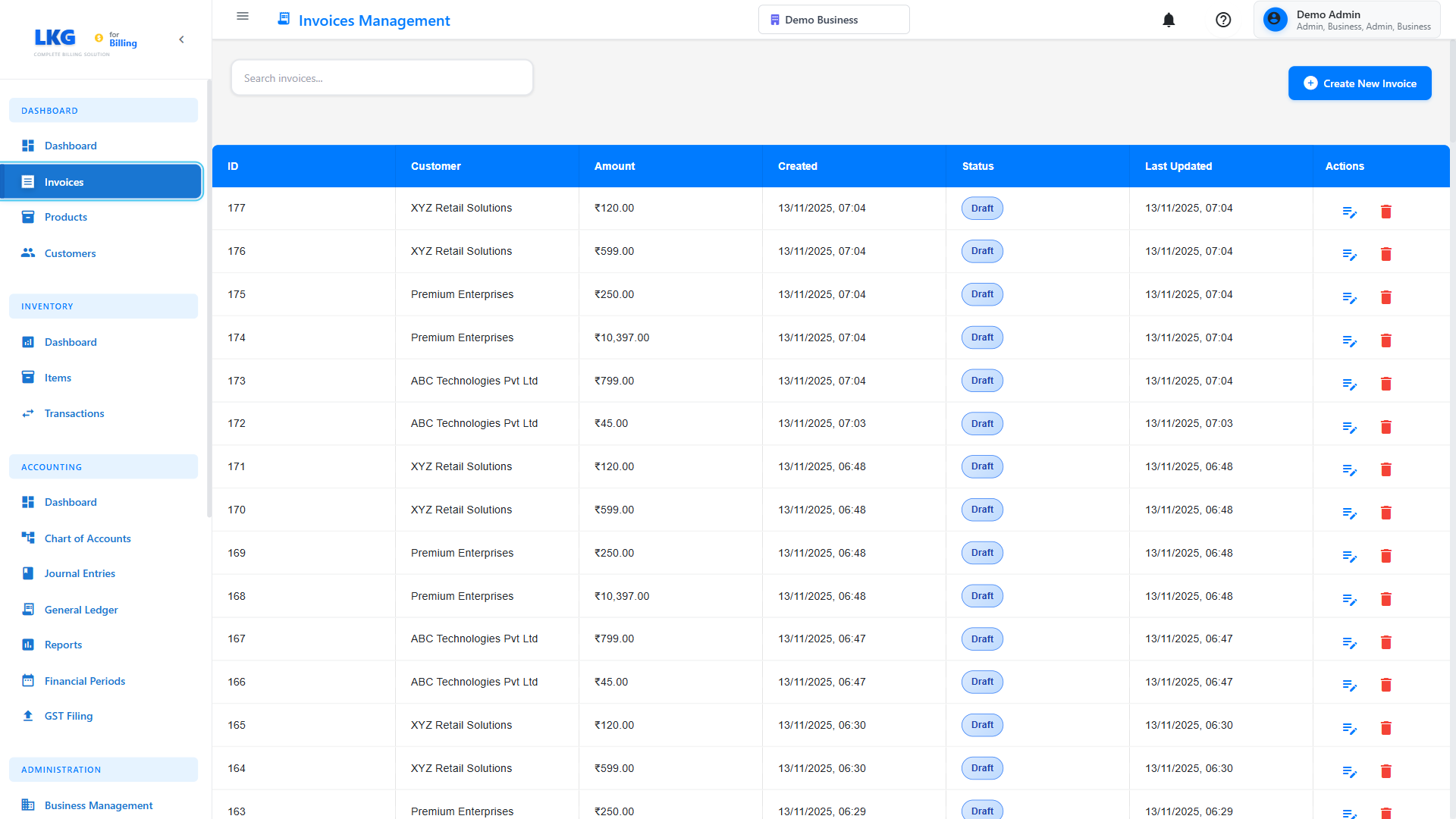

Quick Pay from Invoice List

The fastest way to mark an invoice as paid:

- Go to Invoices page

- Find the invoice in the list

- Click the Actions menu (⋮) or Mark as Paid button

- Confirm the payment details

- Click Save or Record Payment

From Invoice Detail View

- Open the invoice by clicking on it

- Click Record Payment or Mark as Paid button

- Fill in payment details (see below)

- Click Save Payment

Recording Payment Details

Payment Information Form

When recording a payment, enter the following information:

Required Fields:

-

Payment Date - When payment was received

Example:Nov 20, 2024 -

Payment Amount - Amount received

Example:₹5,000 -

Payment Method - How customer paid

Options: Cash, Bank Transfer, Credit Card, Debit Card, Check, UPI, Online Payment

Optional Fields:

-

Reference Number - Transaction ID, check number, etc.

Example:CHK-123456orUTR12345678901 -

Payment Notes - Additional details

Example:Partial payment - balance to follow -

Bank Account - Which bank account received the payment

Select from your configured bank accounts

Payment Method Examples

Cash Payment:

Payment Date: Nov 20, 2024

Amount: ₹5,000

Method: Cash

Reference: CASH-20241120-001

Notes: Received in person

Bank Transfer:

Payment Date: Nov 19, 2024

Amount: ₹10,000

Method: Bank Transfer

Reference: NEFT12345678901

Bank Account: HDFC Business Account

Notes: NEFT transaction

UPI Payment:

Payment Date: Nov 20, 2024

Amount: ₹2,500

Method: UPI

Reference: 434567890123

Notes: Google Pay transaction

Check Payment:

Payment Date: Nov 20, 2024 (deposit date)

Amount: ₹15,000

Method: Check

Reference: CHK-789456

Notes: Check #789456 - deposited to bank

Currently, the system supports marking invoices as fully paid. Payment must match the complete invoice amount.

Full Payment

Marking as Fully Paid

When customer pays the complete invoice amount:

- Open the invoice

- Click Mark as Paid or Record Payment

- Amount auto-fills with total invoice amount

- Enter payment method and date

- Click Save Payment

- Invoice status changes to Paid

- Badge turns green with "Paid" label

Quick Pay with Defaults

Some systems offer quick pay:

- Click Mark Paid button directly from list

- System automatically:

- Uses today's date

- Uses full invoice amount

- Sets default payment method (from settings)

- Payment is recorded immediately

- Great for cash payments or quick entries

Payment Methods

Configuring Payment Methods

Set up your accepted payment methods in Settings:

- Go to Settings → Payment Methods

- Enable/disable payment methods:

- ✅ Cash

- ✅ Bank Transfer

- ✅ Credit Card

- ✅ Debit Card

- ✅ Check

- ✅ UPI/Digital Wallets

- ✅ Online Payment Gateway

- Set default payment method

- Configure bank account details

Payment Method Details

Cash:

- Immediate payment

- No transaction fee

- Manual tracking required

- Good for: Small amounts, in-person sales

Bank Transfer (NEFT/RTGS/IMPS):

- 1-2 day processing (NEFT/RTGS)

- Instant (IMPS)

- Bank charges may apply

- Requires reference number (UTR)

- Good for: Large amounts, business payments

UPI/Digital Wallets:

- Instant transfer

- Low/no fees

- Requires transaction ID

- Good for: Medium amounts, quick payments

Credit/Debit Card:

- Instant payment

- Merchant fees apply (1.5-3%)

- Requires authorization code

- Good for: Online purchases, international

Check:

- 2-7 day clearing

- Bank charges for dishonored checks

- Requires check number

- Good for: Corporate clients, large amounts

Online Payment Gateway:

- Instant confirmation

- Gateway fees apply

- Automatic reconciliation

- Good for: E-commerce, online invoices

Viewing Payment History

Payment Transaction List

To see all payments for an invoice:

- Open the invoice

- Scroll to Payment History or Transactions section

- View table with:

- Payment date

- Amount paid

- Payment method

- Reference number

- User who recorded payment

- Notes

Example Payment History:

| Date | Amount | Method | Reference | Status |

|---|---|---|---|---|

| Nov 1, 2024 | ₹5,000 | UPI | 123456789 | Success |

| Nov 15, 2024 | ₹5,000 | Bank Transfer | NEFT9876543 | Success |

| Nov 30, 2024 | ₹10,000 | Check | CHK-456 | Cleared |

Payment Reports

Generate payment reports:

- Go to Reports → Payment Reports

- Select date range

- Filter by:

- Payment method

- Customer

- Amount range

- Export to Excel or PDF

Handling Overpayments

When Customer Pays Too Much

If a customer accidentally overpays:

- Record the actual payment received (overpaid amount)

- Invoice shows:

Invoice Total: ₹10,000

Paid: ₹12,000

Overpaid: ₹2,000

Status: Overpaid

Overpayment Options

Option 1: Issue Refund

- Process refund to customer

- Record refund transaction

- Update payment to reflect refunded amount

- Invoice shows correct paid status

Option 2: Create Credit Note

- Create a credit note for ₹2,000

- Apply to customer account

- Use credit toward next invoice

- Track in customer balance

Option 3: Apply to Different Invoice

- Create a credit note

- Apply overpaid amount to another unpaid invoice

- Both invoices updated automatically

Payment Reminders

Automated Reminders

Set up automatic payment reminders:

- Go to Settings → Invoice Settings

- Enable Payment Reminders

- Configure reminder schedule:

- 7 days before due date

- On due date

- 3 days after due date

- 7 days after due date

- 15 days after due date

Manual Reminders

Send a one-time payment reminder:

- Go to invoice list

- Filter by Unpaid or Overdue

- Select invoice(s)

- Click Send Reminder

- Review email template

- Click Send

Payment Reconciliation

Matching Bank Deposits

Reconcile payments with bank statements:

- Go to Payments → Reconciliation

- Import bank statement

- Match bank deposits to recorded payments

- Mark as reconciled

- Identify unmatched transactions

Bank Feed Integration

If you have bank integration:

- Connect your bank account in Settings

- Transactions automatically import

- System suggests matching invoices

- Approve or manually match

- Payments automatically recorded

Editing Recorded Payments

Modifying Payment Details

To edit a recorded payment:

- Open the invoice

- Go to Payment History

- Click Edit on the payment row

- Modify:

- Payment date

- Reference number

- Payment method

- Notes

- Cannot change paid amount (delete and re-record instead)

Editing payments creates an audit log entry for compliance.

Deleting Payments

To remove an incorrect payment:

- Open the invoice

- Go to Payment History

- Click Delete or Remove on the payment

- Confirm deletion

- Invoice status reverts (Paid → Unpaid or Partially Paid)

- Record correct payment

Common Scenarios

Scenario 1: Customer Paid Full Amount

Example: Customer pays ₹10,000 invoice via bank transfer

Steps:

- Open the invoice

- Click Mark as Paid

- Select payment method: Bank Transfer

- Enter payment date and reference number

- Click Save Payment

- Invoice status changes to Paid

Scenario 2: Check Bounced

Example: Customer paid with check that was dishonored

Steps:

- Find the invoice marked as Paid

- Go to Payment History

- Delete or mark the check payment as Failed

- Invoice reverts to Unpaid

- Add note: "Check dishonored - pending replacement payment"

- Contact customer for alternate payment

Scenario 3: Wrong Invoice Marked as Paid

Example: Accidentally marked Invoice #1001 as paid instead of #1002

Steps:

- Open Invoice #1001

- Delete the incorrect payment

- Status reverts to Unpaid

- Open Invoice #1002

- Record payment on correct invoice

Scenario 4: Customer Requests Payment Plan

Example: ₹30,000 invoice, customer wants to pay in 3 installments

Solution:

- Agree to payment schedule with customer

- Add note to invoice: "Payment plan: ₹10,000 monthly for 3 months"

- Record first payment: ₹10,000 (Month 1)

- Invoice shows Partially Paid

- Record second payment: ₹10,000 (Month 2)

- Record third payment: ₹10,000 (Month 3)

- Invoice shows Paid

Best Practices

Recording Payments

✅ Record promptly - Enter payments same day received

✅ Match dates - Use actual payment date, not recording date

✅ Add references - Always include transaction IDs

✅ Note details - Add payment notes for clarity

✅ Verify amounts - Double-check amount matches bank deposit

Payment Security

🔒 Verify before marking paid - Confirm money is actually received

🔒 Don't mark paid prematurely - Wait for check clearing

🔒 Document everything - Keep payment receipts and confirmations

🔒 Regular reconciliation - Match to bank statements weekly

🔒 Review overpayments - Investigate why customer overpaid

Troubleshooting

Cannot Mark Invoice as Paid

Possible Reasons:

- Invoice is in Draft status (finalize first)

- You don't have payment recording permission

- Invoice is already paid

- Invoice is deleted

Solutions:

- Finalize draft invoices before recording payment

- Check user permissions with administrator

- Verify invoice status

Payment Not Showing in Reports

Possible Reasons:

- Report date range doesn't include payment date

- Payment not saved properly

- Report filters excluding the payment

Solutions:

- Adjust report date range

- Verify payment was saved (check payment history)

- Remove or adjust report filters

- Refresh or regenerate report

Duplicate Payment Recorded

Problem: Same payment recorded twice by mistake

Solution:

- Open the invoice

- Go to Payment History

- Identify duplicate payment

- Delete one of the duplicate entries

- Invoice status and balance update automatically

Next Steps

- Invoice Overview - Understanding invoice management

- Draft Invoices - Working with drafts

- Editing Invoices - Making changes to invoices

- Deleting Invoices - Removing invoices

Important: Always verify that payment has been received in your bank account before marking an invoice as paid. This prevents cash flow discrepancies and accounting errors.